Hong Kong Customs detects money laundering case with $880 million involved (with photos)

****************************************************************************************

Customs officers first identified a suspected money laundering syndicate in the middle of this year. Subsequent to in-depth investigations, more than 40 officers raided four residential premises in Sau Mau Ping, North Point, Shau Kei Wan and Tai Po on December 9. An office in Central and a licensed MSO in Wan Chai were also searched on the same day. Three men and one woman were arrested for contravention of Organized and Serious Crimes Ordinance (OSCO) and conspiring to "deal with property known or reasonably believed to represent proceeds of an indictable offence" (commonly known as money laundering).

The persons arrested, aged between 42 and 61, were the MSO's three employees and the offshore company's director.

Initial investigation revealed that the three employees were suspected of conspiring with the offshore company by deliberately not carrying out customer due diligence checks over remittance transactions for massive money laundering purposes between May 2018 and April 2019. A total of about $880 million of suspected crime proceeds were processed.

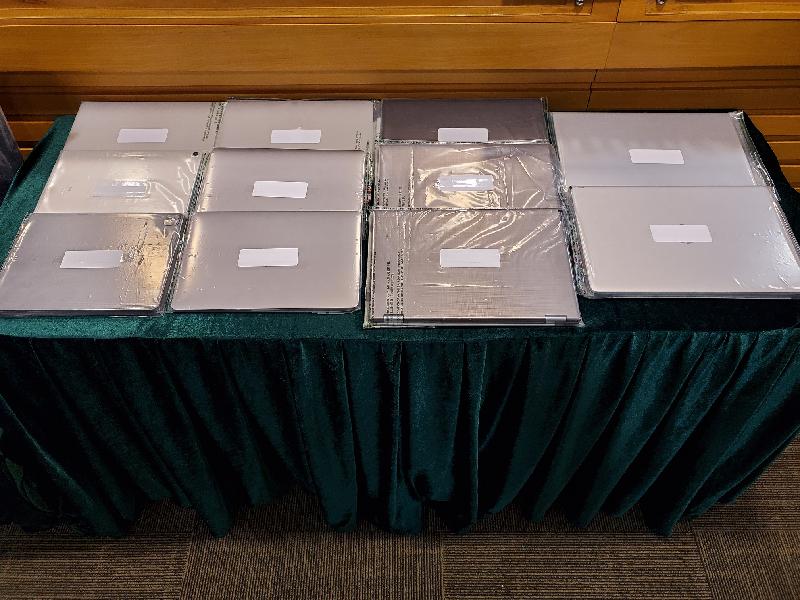

Computers, mobile phones, banking security authentication tokens and a lot of documents, including business registration records, bank statements, tax returns and chequebooks, were seized at the locations searched.

Investigation is ongoing. All arrested persons have been released on bail and further arrests are not ruled out.

Under the OSCO, a person commits an offence if he or she deals with any property knowing or having reasonable grounds to believe that such property in whole or in part directly or indirectly represents any person's proceeds of an indictable offence. The maximum penalty upon conviction is a fine of $5 million and imprisonment for 14 years while the crime proceeds are also subject to confiscation.

Under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), licensed MSOs must abide by the regulations under the AMLO. A person who contravenes the regulations is liable on conviction to a maximum penalty of a $1 million fine and seven years' imprisonment.

Members of the public may report any suspected money laundering activities or violation of the AMLO to Customs' 24-hour hotline 2545 6182 or its dedicated crime-reporting email account (crimereport@customs.gov.hk).

Ends/Tuesday, December 15, 2020

Issued at HKT 12:20

Issued at HKT 12:20

NNNN