SFST highlights Hong Kong's strengths as international financial centre to Indian business community (with photos)

******************************************************************************************

With one of the world's largest populations, India has an enormous market potential for the world and a robust impetus for Indian enterprises to venture overseas. India was Hong Kong's ninth largest trading partner in 2020. With the Comprehensive Avoidance of Double Taxation Agreement between the two places having taken effect from 2018, Hong Kong's competitive edges in a wide range of financial services can complement Indian companies' business development strategies. In the webinar entitled "Hong Kong's Financial Story for Asia and the World", Mr Hui introduced Hong Kong's institutional strengths that underline the city's financial market resilience despite challenges brought by the COVID-19 pandemic.

"The vigour and vibrancy of the Hong Kong economy is not only demonstrated by the remarkable economic recovery in the first quarter of this year, but also by the substantial IPO funds raised and continued capital inflow to our financial market. The International Monetary Fund in a report released last week also reaffirmed Hong Kong's position as an international financial centre with a resilient financial system, sound macroeconomic and prudential policies, and robust regulatory and supervisory frameworks," Mr Hui said.

He pointed out that the development of the Guangdong-Hong Kong-Macao Greater Bay Area has presented immense new opportunities for Hong Kong's financial services sector, which has been serving effectively as a two-way gateway connecting the Mainland and international markets. "The soon-to-be-launched cross-boundary Wealth Management Connect Scheme will expand the financial sector's customer base and boost Hong Kong's role in managing the flow of capital in and out of the Mainland," he added.

Fintech is a key growth engine for Hong Kong's financial industry. The Government has put in place a set of strategies, among which the fintech ecosystem will be nurtured with funding and policies. Mr Hui welcomed Indian financial services companies including fintech start-ups to explore the vast business potential and the composite advantages of Hong Kong.

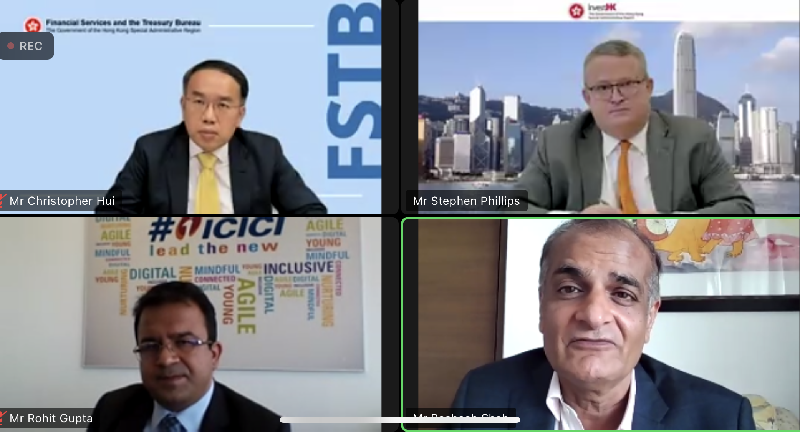

Also speaking at the panel discussion of the webinar were the Chairman of Edelweiss Group, Mr Rashesh Shah, and the Chief Executive of ICICI Bank Hong Kong, Mr Rohit Gupta. They shared their views on why Hong Kong is an important part of their institutions' business strategy in the region and how Hong Kong’s advantages benefit their business operations and growth.

The webinar received an overwhelming response from Indian companies from a wide array of sectors, especially the financial services and consulting sectors. During the question and answer (Q&A) session, participants were interested in learning more about Hong Kong's competitive edges in fintech and asset management, family office operations, opportunities in the financial markets and how Indian enterprises could benefit from developments on these fronts.

The webinar was co-organised by the Hong Kong Economic and Trade Office in Singapore and Invest Hong Kong (InvestHK). It was supported by the Hong Kong Trade Development Council, the Confederation of Indian Industry, the Federation of Indian Chambers of Commerce and Industry, the PHD Chamber of Commerce and Industry and the Indian Chamber of Commerce Hong Kong. The Director-General of Investment Promotion at InvestHK, Mr Stephen Phillips, moderated the panel discussion and Q&A session.

Ends/Tuesday, June 15, 2021

Issued at HKT 21:00

Issued at HKT 21:00

NNNN