|

The Economy

Inflation (in terms of the Composite CPI) |

| 1997 |

5.8% |

| 1998 |

2.8% |

| 1999 |

-2.5% (forecast) |

| |

|

Per capita GDP |

| 1997 |

$206,718 (US$26,701) |

| 1998 |

$192,785 (US$24,892) |

| |

GDP growth |

| 1997 |

5.3% |

| 1998 |

-5.1% |

| 1999 |

0.5% (forecast) |

|

|

Exchange Fund assets (end-April 1999)

$955.7 billion (US$122.5 billion)

(includes foreign exchange, equity and HKD assets) |

|

|

Foreign Exchange holdings (end-May 1999)

US$88.9 billion |

Hong Kong's economy stabilised somewhat in the first quarter of 1999 after being

hit badly by fallout from the Asian financial crisis in 1998.

There were several encouraging signs in the early part of 1999:

- Exports of goods to a number of East Asian markets had recovered, as the regional

economic situation stabilised. Inbound tourism continued to revive strongly

- Local sentiment had improved upon a more stable financial situation, improved

bank liquidity and successive cuts in nominal interest rates

- The government's first land auction in almost a year attracted keen bidding,

in tandem with a visible pick-up in the residential property market

- The local stock market had become more active, partly due to greater liquidity

Outlook for 1999

Exports of goods and services should improve further in 1999 as the East Asian economies

continue to recover while the situation elsewhere overseas holds steady. The growth

momentum of inbound tourism should be sustained.

Although private sector investment may remain slack until the overall business outlook

turns visibly better, public sector building and construction activity should continue

to gather momentum to provide an offset.

Consumer spending should pick up steadily from the very low level last year in line

with improved consumer sentiment.

Overall economic activity is expected to rebound more appreciably in the latter part

of the year. For 1999 as a whole, Hong Kong's GDP growth rate in real terms is forecast

at 0.5%.

Consumer prices look set to ease further for the rest of the year. The Composite

Consumer Price Index is forecast to decline by 2.5% in 1999, against a 2.8% increase

in 1998.

Asian Financial Crisis

The Asian financial crisis hit Hong Kong in August 1998, when the Hong Kong Dollar

as well as the futures and stock markets came under heavy speculative attack. Very

low liquidity in the stock and money markets created ideal conditions for market

manipulators to create instability across the financial markets through a 'double-play'

strategy.

Under Hong Kong's currency board system, interest rates rise automatically when there

is selling pressure on the Hong Kong Dollar. This in turn leads to an outflow of

funds from the stock market - and a drop in share prices.

By carefully timing relatively large withdrawals of funds from the money, stock and

futures markets, the manipulators attempted to engineer extreme conditions in the

financial markets to manipulate interest rates, share prices and stock indices virtually

at will. Their tactics created an uneven playing field.

Severe and sustained market disorder prompted the government to launch a defensive

incursion into the stock and futures markets in mid-August. The government spent

a total of HK$118 billion (US$15.1 billion) buying the 33 constituent stocks of the

Hang Seng Index. During the defence, turnover reached a record HK$79 billion (US$10.1

billion) on August 28, the last day of trading for the month.

Although controversial, the actions preserved the integrity of the financial markets

and prevented a general loss of confidence in Hong Kong's economy. The government's

actions were generally well received by both the domestic and international community.

Opinion within the investment community was divided between those who believed it

was the right thing to do under such contrived and unusual circumstances and those

who believed market forces should have been given free reign and that the Hong Kong

SAR Government had broken a cardinal rule by intervening in the stock market.

The Financial Secretary Donald Tsang said on many occasions after the incursion:

"We took pragmatic steps to keep our economy intact rather than see it overwhelmed

by manipulative market activities and suddenly implode. We felt it was better to

have a market in which to invest than to have no market at all."

" The actions were taken with the following objectives:

- To protect and reinforce the integrity of the Hong Kong Dollar's linked exchange

rate with the US Dollar under the currency board system. The HKSAR Government is

absolutely determined to maintain its linked exchange rate.

- To stop the manipulation of the stock and money markets by some over-aggressive

market players.

- To reintroduce stability and a level playing field into the markets which were

in dire danger of over-correcting.

It should also be noted that:

- There is no intention to delink the Hong Kong Dollar from the US Dollar. The

HKSARG's actions were, first and foremost, designed to protect the link that has

served Hong Kong well since it was introduced in October 1983. In a highly-externally

oriented economy such as Hong Kong's - with a trade-to-GDP ratio of about 250% -

currency stability is of the utmost importance, and indeed a necessity. The link

is here to stay.

- The HKSARG did not buy shares to support the market at any particular level.

Shares were bought to stop a contrived manipulation by aggressive investors who were

creating severe instability in the stock, futures and currency markets. The stock

and property markets in particular could not find their true levels in such an unsettled

environment.

- A company - Exchange Fund Investment Ltd - was set up at arm's length from the

government and the Hong Kong Monetary Authority to manage the share portfolio, with

the long-term aim of reducing the government's Hong Kong equity holdings to an amount

equal to about 5% of the total assets of the HKSARG's Exchange Fund. The government's

Hong Kong equity share portfolio was valued at HK$190 billion (US$22.8 billion) at

the end of April 1999, of which approximately HK$46 billion will be retained. In

April 1999, three financial advisers - Jardine Fleming, ING Barings and Goldman Sachs

- were appointed to advise Exchange Fund Investment Ltd on the share disposal.

Following the incursion, the government announced a 30-point plan to strengthen

the transparency and order of the securities and futures markets. Those measures

focused on further improvement of rule enforcement, operation system, risk management

and inter-market surveillance, which were widely in line with international practices

and standards.

In late September 1998, the Financial Secretary departed on a three-week mission

to Frankfurt, Munich, The Hague, Amsterdam, Washington, New York, Boston, London

and Edinburgh to explain the intervention and attend the annual World Bank/IMF meetings.

During his many meetings with central bankers, leading economists, academics, think-tanks

and business groups Mr Tsang stressed the need for greater transparency in global

capital flows, greater discipline and better risk assessment by banks and the need

to involve emerging markets in any planned reforms of the global financial architecture.

Mr Tsang also raised these issues in October 1998 during a special meeting in Washington

called by President Bill Clinton of the G-22 finance ministers.

The collapse of the US-based, Long-Term Capital Management hedge fund - and a subsequent

intervention by the US Federal Reserve to prevent systemic risk resulting from the

collapse - served to highlight the dangers of massive and unregulated short-term

capital flows.

G-7 leaders also acknowledged the need to rein in rogue capital flows which had led

to massive disruption of the financial markets and economies in Asia, Russia and

South America throughout 1998. G-7 has set up a Financial Stability Forum with three

working groups to look into highly-leveraged institutions (HLIs), offshore centres

and short-term capital flows. The HKSARG has been invited to join the group on HLIs

The HKSARG continues its efforts to push for greater transparency and monitoring

of global capital flows and HLIs in such fora as APEC, the World Bank/IMF and the

G-7 Financial Stability Forum.

Bank for International Settlements

The Bank for International Settlements opened its Representative Office for Asia

and the Pacific in Hong Kong on July 11, 1998. It was the bank's first overseas office

and it serves as a regional centre for Asia. The bank, founded in 1930, is an international

financial organisation with a membership of 45 shareholding central banks. The establishment

of the office in Hong Kong is an indication of Hong Kong's growing importance as

an international financial centre and as the premier banking centre in Asia.

Trade

Hong Kong was the world's 9th-largest trading entity in goods in 1998 -the 5th largest

if the European Union is taken as a single entity.

Total trade in goods in 1998 was HK$2,777 billion (US$358.5 billion) compared with

HK$3,071 billion (US$396.7 billion) in 1997 - a drop of about 9.5%. This was mainly

due to slack demand within the region as a result of the Asian financial crisis.

Hong Kong accounted for 3.3% of the world's total merchandise trade in 1998, compared

with 3.62% in 1997.

Total trade in goods for the first quarter of 1999 decreased by 11.6% year-on-year.

Hong Kong was the world's 10th-largest exporter of services in 1998, and the world's

12th-largest services trading entity.

Protecting Intellectual Property

In the biggest raid yet on a single operation, Customs Officers on June 13, 1999,

seized more than 180 000 pirated CD-Rom computer games and production equipment worth

an estimated HK$16 million (US$2.1 million). The raid was part of concerted and ongoing

efforts to stamp out infringements against intellectual property rights.

Hong Kong has one of the world's toughest intellectual property regimes, but copyright

piracy and trademark infringement remains a matter of serious concern for Hong Kong

as an international trading centre.

Hong Kong has a multi-pronged approach to tackle the problem: comprehensive legislation;

enforcement and prosecution; and, public education.

In the past year the Customs and Excise Department has been given extra resources

to step up action against the manufacturers and sellers of pirated or fake goods.

It will continue to take strong enforcement action to severely curtail these illegal

practices.

In 1998, Customs officers seized 39 million pirated optical discs (CDs, VCDs, DVDs),

with a market value of HK$960 million (US$123 million) and arrested 1 645 people.

In the first five months of 1999, Customs officers had seized 6.18 million pirated

optical discs with a market value of HK$111 million (US$14.2 million) and arrested

851 people.

Counterfeit goods worth HK$52 million (US$6.67 million) were seized and 760 persons

arrested in 1998. In the first five months of 1999, some 340 people have been arrested

and 18 million items of fake goods with a market value of HK$32.3 million (US$4.1

million) have been seized.

The Intellectual Property Department (IPD) takes a pro-active approach in its public

education drive. Its schools visit programme - the only one of its kind in the world

-is taking the anti-piracy message to all of Hong Kong's 400 secondary schools over

a five-year period.

Primary schools receive a free, special teaching kit which helps younger children

understand the importance of protecting original work through role play exercises

and a video featuring messages from pop and movie stars such as kung fu hero Jackie

Chan.

Presentations to tertiary institutions focus on students' special areas of interest.

Budding actors, for example, perform in a play with a script about protecting copyright;

young design students are told about the importance of registering designs, and how

they are protected in law.

Talks to political groups, influential organisations and civil servants such as trade

officials and police officers are also arranged to spread the message even further.

Tourism

Despite a significant drop in tourism arrivals in 1998, Hong Kong remained the most

popular destination in Asia after the Mainland.

By the end of April 1999, visitor arrivals had risen for the 10th consecutive month.

Arrivals from January to end-April 1999 were 3.4 million, a 12.7% increase compared

with the same time in 1998. Hotel occupancy levels for the first quarter of 1999

were also higher than the first quarter in 1998.

Tourism receipts and arrivals in 1998 were significantly down on 1997, due mainly

to a big drop in arrivals from Japan and Southeast Asia and the substantial downward

price adjustment in Hong Kong.

In 1998, there were 9.57 million arrivals, compared with 10.4 million in 1997 and

a record 11.7 million in 1996. Receipts in 1998 were HK$55.3 billion (US$7.1 billion),

compared with HK$72.1 billion (US$9.3 billion) in 1997.

Arrivals from the Mainland of China increased by 300 000 to 2.6 million in 1998,

making them the biggest source of visitors. The second largest group was from Taiwan

(1.81 million), followed by Japan (950 000), the USA (770 000) and Singapore (330

000).

The top five visitor sources on a per capita spending basis were South Africa (HK$6,525/US$836),Switzerland

(HK$6,330), Belgium (HK$6,229), the Philippines (HK$6,205) and USA (HK$6,083).

The new Hong Kong International Airport, opened on July 6, 1998, will also help the

tourism industry because significantly increased capacity provides greater flexibility

in airline scheduling, as well as the opportunity to add more scheduled flights and

new destinations.

For example, six new air services agreements with Austria, Papua New Guinea, Nepal,

Oman, Russia and Qatar have been signed since the airport opened, taking the number

of air service agreements to 36. More are in the pipeline.

The 1999/2000 Budget contained new initiatives to help Hong Kong consolidate its

position as Asia's premier tourist destination, as well as act as a catalyst to attract

more visitors and return visits. The measures include:

- Appointing a Commissioner for Tourism in May 1999 to spearhead efforts to promote

the development of the tourist industry

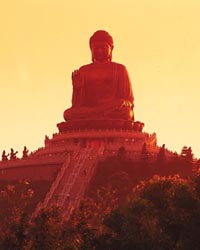

- Plans for a major theme park on Lantau Island

- A HK$500 million (US$64 million) loan to the aquatic theme park Ocean Park to

develop a new Adventure Bay theme area, including a new dolphinarium and a new water

ride

- Exempting same-day transit passengers from paying Departure Tax to encourage

them to visit Hong Kong attractions if their flight schedule permits

Medium and long-term measures

The following projects are either in the pipeline or under serious consideration

by the government to enhance Hong Kong's attraction as an international tourism destination:

- Scenic cable car system on Lantau Island

- New world-class, state-of-the-art performance venue

- An International Wetland Park near Mai Po Marshes conservation area, a designated

wetland of international importance. Construction will begin in 2000

- A Heritage Tourism Task Force to focus on individual initiatives and map out

a broader strategy to promote heritage tourism

- A HK$100 million (US$12.8 million) International Events Fund to help stage some

50 major international events in Hong Kong from 1998-2003. These events will help

promote Hong Kong as the events capital of Asia as well as generate considerable

tourism receipts and visitor arrivals

Labour and Employment

Hong Kong's unemployment rate hit an all-time high of 6.3% for the three months ending

April 1999. More than 215 000 people are out of work from a workforce of some 3.2

million. The hardest hit sectors have been the decoration and maintenance and retail

trades.

However, total employment increased by 110 000 in 1998 which indicates that the worsening

unemployment is due more to an increase in manpower supply, rather than a decline

in the number of jobs available.

There is still a certain degree of job mismatch in the labour market as there were

also 9 000 job vacancies at the end of December 1998. The government continues to

address the problem through training and retraining programmes and by strengthening

job matching and employment services. Training capacity of the Employees Retraining

Board has been increased by 23%, which will allow 95 000 people to benefit in the

1999/2000 fiscal year.

A top-level Task Force on Employment, headed by the Financial Secretary, held its

first meeting in June 1998. It has met regularly over the past year and devised a

wide range of measures to ease unemployment and help job creation. These included

advancing government projects and tightening measures to combat illegal employment.

It is estimated that these policy initiatives, coupled with a HK$235 billion (US$30

billion) infrastructure programme over the next few years will create some 120 000

jobs within 1999/2000.

|

Last updated: June 1999 |

|

|